Understanding Compliance and Optimizing the Potential of DHE SDA

The Government of Indonesia has issued Government Regulation (PP) No. 8 of 2025, which regulates the obligation to repatriate and place Foreign Exchange Earnings (DHE) from the exploitation, management, and/or processing of Natural Resources (SDA) into the Indonesian financial system.

What is DHE SDA and Who is Required to Comply?

DHE SDA refers to foreign exchange from exports of natural resource commodities such as those from the Mining, Plantation, Forestry, and Fisheries sectors.

If there is DHE SDA income with an Export Declaration (PPE) value of at least USD 250,000 or equivalent, exporters from these sectors are required to repatriate the export proceeds into the Indonesian financial system through a special account at a foreign exchange bank or the Indonesia Eximbank (LPEI).

Placement of DHE SDA Funds

Exporters are required to place the funds in DHE SDA placement instruments with the following placement amount and duration:

DHE SDA can be placed in the following instruments:

Flexibility in the Use of DHE SDA

As long as the funds remain in the special account and have not yet been placed into other instruments, exporters can use the fund for:

-

Currency exchange into Rupiah at the same bank

-

Payment of taxes/government obligations

-

Dividend payments

-

Import of goods/services

-

Repayment of foreign currency loans

Utilization of DHE SDA and Incentives

DHE SDA instruments may now also be used for FX Swap Transactions and as Collateral for Rupiah Loans. As an additional incentive, exporters enjoy a 0% income tax rate (PPh) on interest earned from DHE SDA placement instruments.

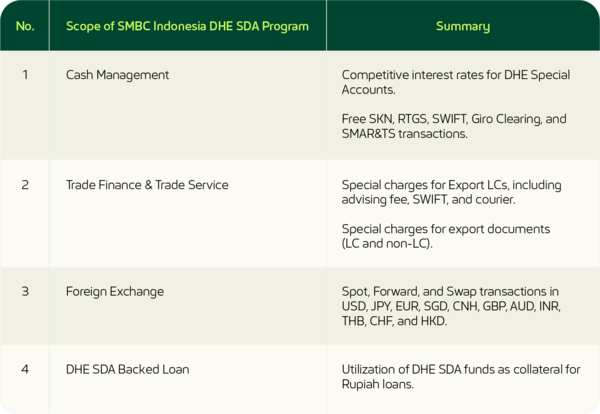

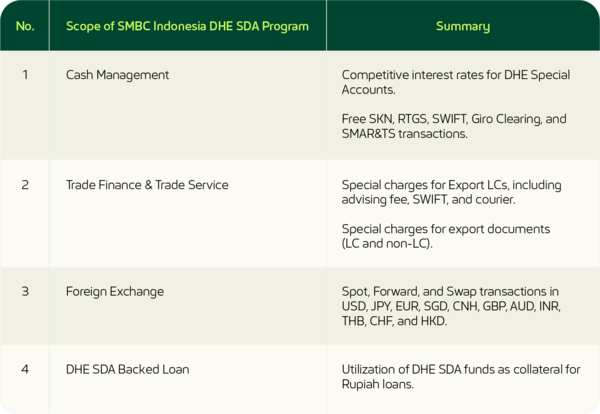

Understanding and implementing the DHE SDA policy is key to running export activities that are sustainable and in accordance with regulations. SMBC Indonesia is here to assist you with repatriation, placement, usage, and utilization by offering the following DHE SDA programs for customers:

For more details, please download the material below.

Contact your Relationship Manager immediately to get solutions and guidance related to DHE SDA according to your company’s needs.